Can I Write Off Gambling Losses In 2018

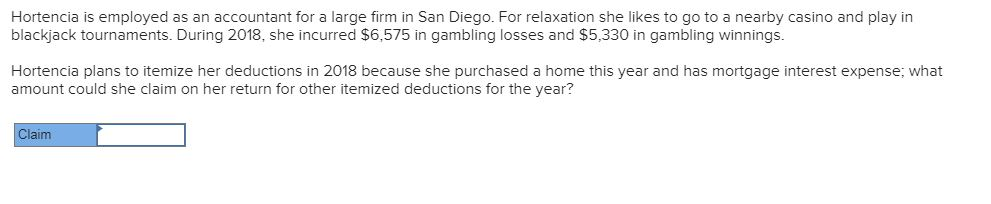

The rule for claiming gambling losses is that you can only claim up to the dollar amount you won gambling. If Form 1099G from the IRS shows gambling winnings of $5,000, you can claim losses of no more than $5,000, even if your losses were far greater. Gambling Losses – Currently, gambling losses are only deductible in an amount equal to gambling winnings. Under Trump’s plan, these losses would no longer be deductible, meaning that taxpayers would have to pay taxes on all their winnings – even if they have net losses. Finally, if your gambling activities rise to the point where it’s a business (i.e., you’re a professional gambler), you can deduct an annual loss. However, under the TCJA, taxpayers can no longer include non-wagering expenses, such as travel, in any loss that is deductible. This change takes effect in 2018. Is gambling a tax write off/ deductible in 2018. Also how much of a tax break will I see with a 40,000 per year salary. Can someone do the math crunch some numbers and let me know pretty close to what I'll save in 2018 compared to last year.

If you gamble, be sure you understand the tax consequences. Both wins and losses can affect your income tax bill. And changes under the Tax Cuts and Jobs Act (TCJA) could also have an impact.

Wins and taxable income

You must report 100% of your gambling winnings as taxable income. The value of complimentary goodies (“comps”) provided by gambling establishments must also be included in taxable income as winnings.

Winnings are subject to your regular federal income tax rate. You might pay a lower rate on gambling winnings this year because of rate reductions under the TCJA.

Amounts you win may be reported to you on IRS Form W-2G (“Certain Gambling Winnings”). In some cases, federal income tax may be withheld, too. Anytime a Form W-2G is issued, the IRS gets a copy. So if you’ve received such a form, remember that the IRS will expect to see the winnings on your tax return.

Losses and tax deductions

You can write off gambling losses as a miscellaneous itemized deduction. While miscellaneous deductions subject to the 2% of adjusted gross income floor are not allowed for 2018 through 2025 under the TCJA, the deduction for gambling losses isn’t subject to that floor. So gambling losses are still deductible.

But the TCJA’s near doubling of the standard deduction for 2018 (to $24,000 for married couples filing jointly, $18,000 for heads of households and $12,000 for singles and separate filers) means that, even if you typically itemized deductions in the past, you may no longer benefit from itemizing. Itemizing saves tax only when total itemized deductions exceed the applicable standard deduction.

Also be aware that the deduction for gambling losses is limited to your winnings for the year, and any excess losses cannot be carried forward to future years. Also, out-of-pocket expenses for transportation, meals, lodging and so forth can’t be deducted unless you qualify as a gambling professional.

And, for 2018 through 2025, the TCJA modifies the limit on gambling losses for professional gamblers so that all deductions for expenses incurred in carrying out gambling activities, not just losses, are limited to the extent of gambling winnings.

Can I Write Off Gambling Losses In 2018 Without

Tracking your activities

To claim a deduction for gambling losses, you must adequately document them, including:

Can I Write Off Gambling Losses In 2018 Tax

- The date and type of gambling activity.

- The name and address or location of the gambling establishment.

- The names of other persons (if any) present with you at the gambling establishment. (Obviously, this is not possible when the gambling occurs at a public venue such as a casino, race track, or bingo parlor.)

- The amount won or lost.

You can document income and losses from gambling on table games by recording the number of the table you played and keeping statements showing casino credit issued to you. For lotteries, you can use winning statements and unredeemed tickets as documentation.

Please contact us if you have questions or want more information about the tax treatment of gambling wins and losses.

© 2018

If you gamble, you may not feel like as much of a winner come tax season next year. Changes in the State of Oklahoma tax law a limiting how much you can write off as a 'loss.'

'I see this for Oklahoman's as like the gambling penalty,' said Eileen Robinson, the head accountant at Gardner's Tax Services Inc.

In previous years, you could write off your total gambling losses in your adjusted income which is what you can still do for federal taxes, but for Oklahoma state taxes, you can't do that anymore.

'For federal you have to show in the income on the 1040, your schedule 'A' is where you take your itemized deductions and that's where you right off your gambling losses,' Robinson said. 'In Oklahoma, they limited the amount of itemized deductions you can take, you can take all of your donations but it limits the rest of it to that 17,000.'

This means you'll have to pay income tax for the total amount of big jackpots.

In the past, if you lost money while gambling, then won, you could deduct those losses from your winnings then only pay the tax on the difference.

'Now when you win that money you're going to have to pay the taxes whether you out that money back into the machine or not,' Robinson said.

Something that Robinson says has been an unpleasant surprise for her clients this year.

'They're in shock, most of them didn't know and of course not until we got ready to do their taxes,' Robinson explains.

It may be too late to make the adjustment this year, but there are ways to prepare for the tax change next season.

'I'd say 5% of all their winnings needs to be set aside to send in' Robinson said. 'So lets say if you won something you need to make sure you set back enough to be able to pay the taxes for the state and try not to plug that into the machine.'

Stay in touch with us anytime, anywhere.

Download our free app for Apple and Android and Kindle devices.

Sign up for newsletters emailed to your inbox. Select from these options: Breaking News, Severe Weather, School Closings, Daily Headlines and Daily Forecasts.

Like us on Facebook